How to change tax (VAT) amount on sales line from code (BC SaaS)

samantha73

Member Posts: 121

Hi Guys

I have asked this question in another forum but haven't found a proper answer or why others haven't found this problem. When synching orders from web store like Amazon we need to change the tax amount per line to accommodate for rounding etc. And the statistics page where we do this in front end is a temp table. Has anyone got a solution if we are synching SO from API call?

I have asked this question in another forum but haven't found a proper answer or why others haven't found this problem. When synching orders from web store like Amazon we need to change the tax amount per line to accommodate for rounding etc. And the statistics page where we do this in front end is a temp table. Has anyone got a solution if we are synching SO from API call?

0

Answers

-

Hi,

NAV uses VAT posting groups for calculating the VAT. I would suggest you to adjust "vat bus posting grup" in SO lines (if you are creating SO's)

I recall there was a field you could tell type="full vat" and you could tell that line is all VAT and exclude any vat from the other lines etc.

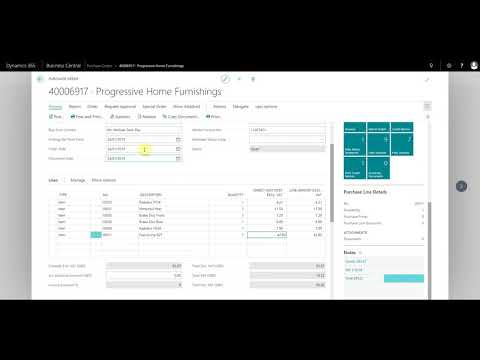

maybe this video will help, how to manually amend vat https://www.youtube.com/watch?v=zBXttdf0byg

https://www.youtube.com/watch?v=zBXttdf0byg

another one: https://www.youtube.com/watch?v=qSBdnznrPaE

https://www.youtube.com/watch?v=qSBdnznrPaE

0 -

Yes we can adjust through front end but the issue is accessing the same logic from back end. I think I have to look for the code units behind as the statistics table is temporary. Other methods of setting vat prod/bus posting groups will not work as the main issue is rounding so you need to specify exact amount overwriting BC default0

-

samantha73 wrote: »Yes we can adjust through front end but the issue is accessing the same logic from back end. I think I have to look for the code units behind as the statistics table is temporary. Other methods of setting vat prod/bus posting groups will not work as the main issue is rounding so you need to specify exact amount overwriting BC default

Ths statistcs are calculated "on the go", when you press them.

I'm not sure if I understand why you need to adjust the rounding per line and document coming from amazon.

I'm not an expert in this area but when you create an invoice, you always do based on the VAT % you have to pay to that country, thats all.

Could it be the issue with currency rounding?

1

Categories

- All Categories

- 73 General

- 73 Announcements

- 66.7K Microsoft Dynamics NAV

- 18.8K NAV Three Tier

- 38.4K NAV/Navision Classic Client

- 3.6K Navision Attain

- 2.4K Navision Financials

- 116 Navision DOS

- 851 Navision e-Commerce

- 1K NAV Tips & Tricks

- 772 NAV Dutch speaking only

- 617 NAV Courses, Exams & Certification

- 2K Microsoft Dynamics-Other

- 1.5K Dynamics AX

- 329 Dynamics CRM

- 111 Dynamics GP

- 10 Dynamics SL

- 1.5K Other

- 990 SQL General

- 383 SQL Performance

- 34 SQL Tips & Tricks

- 35 Design Patterns (General & Best Practices)

- 1 Architectural Patterns

- 10 Design Patterns

- 5 Implementation Patterns

- 53 3rd Party Products, Services & Events

- 1.6K General

- 1.1K General Chat

- 1.6K Website

- 83 Testing

- 1.2K Download section

- 23 How Tos section

- 252 Feedback

- 12 NAV TechDays 2013 Sessions

- 13 NAV TechDays 2012 Sessions